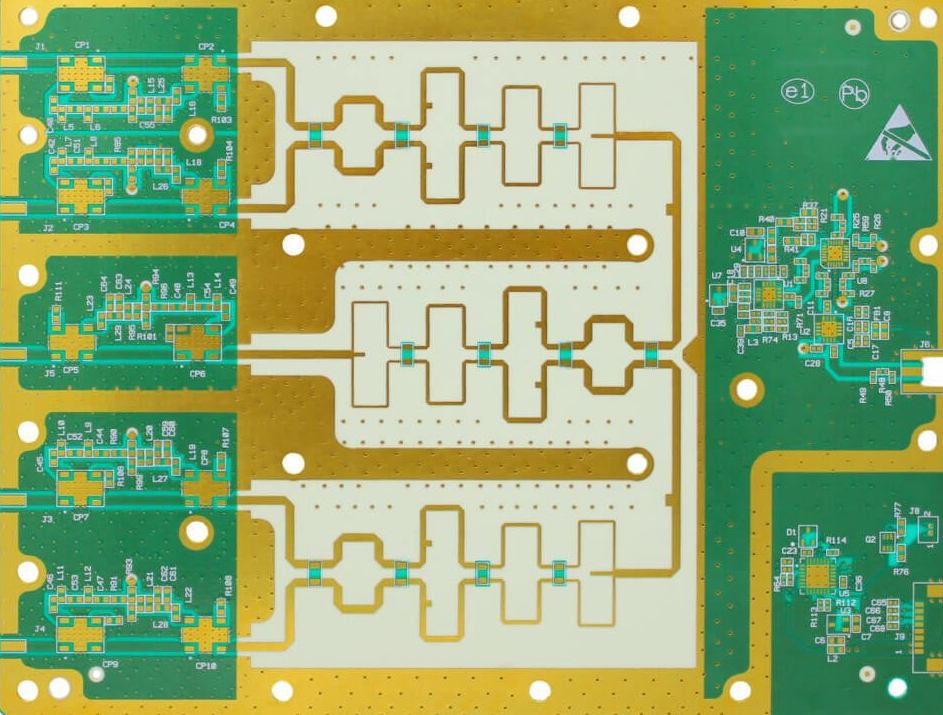

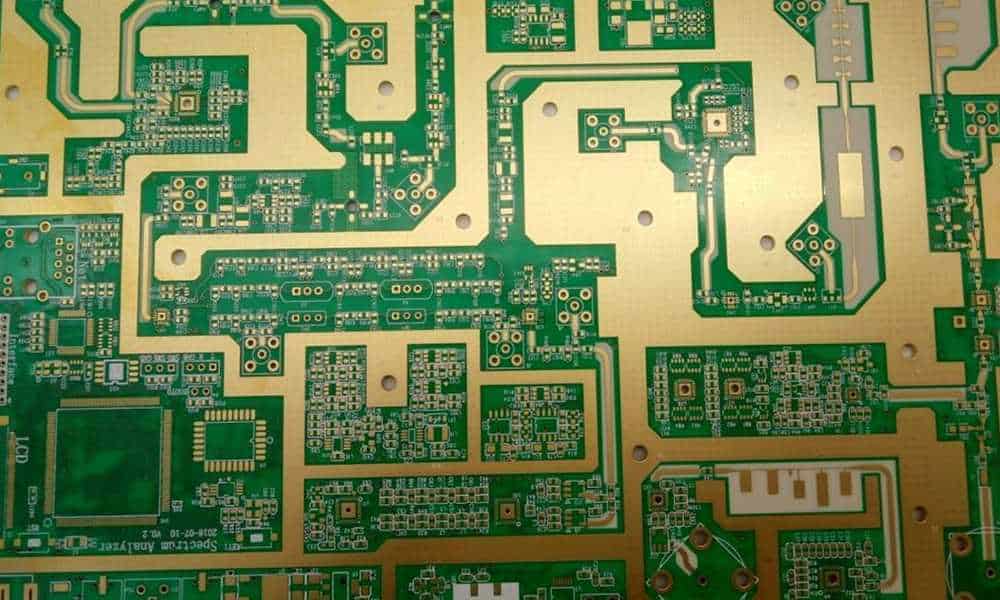

Printed circuit boards (PCBs) that operate at radio frequencies (RF) are essential components in various electronic devices that need to receive and transmit signals wirelessly. RF PCBs are used in products like smartphones, tablets, WiFi routers, base stations, satellites, defense and aerospace systems, automobiles, IoT devices and more.

As wireless technologies continue to advance and get adopted across industries, the demand for RF PCBs keeps increasing each year. This article will rank the top 10 global manufacturers of RF PCBs based on their revenue, production capabilities, technology leadership and impact on the industry in 2024.

Ranking Methodology

The rankings are based on a weighted scoring system across four key metrics:

- Revenue – Total yearly revenue from sales of RF PCBs

- Production Capacity – Volume and scale of RF PCB manufacturing facilities

- Technology Leadership – R&D spending and new innovations in RF PCB tech

- Industry Impact – Influence on setting trends and pioneering new applications

Higher weights have been assigned to the Revenue and Production Capacity parameters as they directly reflect business performance. Now let’s look at the top 10 leaders in RF PCB production for 2024.

1. Rayming Technology

Rayming is expected to be the top RF PCB manufacturer globally in 2024 based on its strong focus and expertise in high-frequency PCB technologies. Some key facts:

Revenue: $1.2 billion (RF PCB Division)

Production Capacity: Over 200,000 sq. meters of manufacturing space

Facilities: Taiwan and China

Key Technologies: Rigid-flex PCBs, Thermal Management, Automotive Electronics

Rayming has been at the forefront of developing advanced material and process solutions for RF PCBs used in smartphones, communication infrastructure, vehicles, aerospace and militar applications. Its world-class R&D and vertically integrated production enable it to meet the growing market demand.

2. TTM Technologies

TTM Technologies will take the 2nd spot with its expertise in HDI and other specialty PCB technologies seeing high growth in wireless components:

Revenue: $850 million+ (Estimate for RF/HDI/Flex PCB)

Production Capacity: 69 manufacturing lines across 10 plants

Facilities: North America and Asia

Key Technologies: HDI, Flex, Rigid-Flex PCBs, Aerospace & Defense

From 5G infrastructure to defense systems – TTM produces high-quality RF PCB solutions with complex integration and miniaturization capabilities required for advanced electronic devices and modules.

3. Compeq Manufacturing

Compeq will move up from #4 in 2023 to #3 in 2024 through significant capacity expansions catering to communication and consumer applications:

Revenue: $780 million

Production Capacity: 1.2 million sq. meters

Facilities: China, Taiwan

Key Technologies: HDI, Rigid-Flex, Substrate PCBs

Compeq specializes in supplying PCBs for smartphones and other connected devices. It is also increasing RF PCB capacities to support 5G infrastructure and WiFi6/6E access points.

4. Tripod Technology

Tripod Technology makes it to the top 5 RF PCB producers with a strong reputation in manufacturing high-frequency boards for wireless and fiber optic communications:

Revenue: $610 million

Production Capacity: Over 1 million sq. meters

Facilities: Taiwan, China, Japan

Key Technologies: High-frequency RF Boards (up to 150 GHz), LTCC Substrates

Tripod’s advanced RF PCBs and ceramic substrates enable high-precision, stable electrical performance for mmWave equipment, radar and satellite systems used in 5G networks.

5. Sumitomo Denko

Sumitomo Denko, a Japanese giant, comes next with decades of experience in cling film and COPPER-CLAD LAMINATES (CCL) – a key raw material for making PCB substrates:

Revenue: $530+ million (Estimate for RF PCB portion)

Production Capacity: 330,000 tons/year of CCL

Facilities: Japan, China, Taiwan, USA

Key Technologies: Rigid PCBs, High-Frequency Material Solutions

Leveraging its expertise in CCL and resin technologies – Sumitomo produces quality RF PCB material solutions for various communication infrastructure applications.

6. Unimicron Technology

Unimicron is expected to accelerate RF PCB production to support growing demand from auto, mobile and 5G operators:

Revenue: $470 million (RF PCB Estimate)

Production Capacity: Over 2 million sq. meters

Facilities: Taiwan, China, Germany, USA

Key Applications: Automotive Electronics, HDI Boards for Smartphones

Unimicron already supplies RF PCBs for radar sensors, ADAS systems, infotainment modules used in electric and autonomous vehicles – a high-growth segment.

7. Nan Ya PCB

Nan Ya PCB has invested significantly to expand its RF PCB manufacturing capability with a focus on communication sector:

Revenue: $460+ million

Production Capacity: Over 40 production lines

Facilities: China, Taiwan

Key Applications: Communication Infrastructure, 5G Base Stations

Nan Ya uses its RF/microwave and semiconductor substrate expertise to enable next-gen wireless network applications – 5G base stations, small cells, remote radio heads etc.

8. Hitachi Chemical

Hitachi Chemical makes high-performance laminate materials which serve as the foundation for RF PCBs used in high-speed communication:

Revenue: $420+ million (Electronic Materials Segment)

Production Capacity: Over 130 tons/month of thermoset laminates

Facilities: Japan, China, Taiwan, South Korea, USA

Key Products: Rigid laminates for 5G mmWave equipment

Hitachi’s circuit substrates help achieve superb electrical and high-frequency characteristics needed in mmWave antennas and modules (~30-100 GHz range).

9. Shengyi Technology

Shengyi is a leading Chinese manufacturer specializing in high-end RF PCBs with excellent signal transmission quality meeting aerospace industry standards:

Revenue: $400 million

Production Capacity: 820,000 sq. meters

Facilities: China (Mainland, Taiwan)

Key Applications: Satellites, UAVs, Radars, Defense Electronics

Shengyi’s certified RF PCB fabrication capabilities make it a preferred choice for the specialized defense and aerospace industries.

10. Trislot Technology

Finally, Trislot Technology enters the top 10 RF PCB companies list through its partnership with European semiconductor giant, NXP:

Revenue: $380+ million

Production Capacity: Unknown

Facilities: Europe (Netherlands)

Key Applications: Automotive Radars and Infotainment Modules

Leveraging NXP chip technologies, Trislot manufactures high-precision RF PCB solutions catering to the surging automotive radar market.

Summary Table

Here is a summary of the top 10 RF PCB manufacturers expected in 2024:

| Rank | Company | Country | Key Technologies |

|---|---|---|---|

| 1. | Taiflex Scientific | Taiwan | Rigid-Flex PCBs, Thermal Management |

| 2. | TTM Technologies | USA | HDI, Flex, Rigid-Flex |

| 3. | Compeq Manufacturing | China/Taiwan | Rigid-Flex PCBs |

| 4. | Tripod Technology | Taiwan | High-Frequency RF Boards |

| 5. | Sumitomo Denko | Japan | Rigid PCBs |

| 6. | Unimicron Technology | Taiwan | HDI Boards |

| 7. | Nan Ya PCB | Taiwan | Microwave Substrates |

| 8. | Hitachi Chemicals | Japan | Thermoset Laminates |

| 9. | Shengyi Technology | China | Aerospace-grade RF PCBs |

| 10. | Trislot Technology | Europe | Automotive Radar Modules |

Industry Outlook and Trends

The global RF PCB market is forecast to grow at 6%+ CAGR during 2022-2026, driven by:

- 5G Infrastructure Investments: Expansion of 5G networks supporting new mmWave frequency bands will drive volume demand for high-performance RF PCBs.

- Defense Electronics Spending: Radar systems, electronic warfare and satellite communication adopting phased array and other RF antenna technologies are growth hotspots.

- WiFi 6E Adoption: Consumer WiFi access points and routers upgrading to the new 6 GHz band will further boost RF PCB consumption.

- Rise of Autonomous Vehicles: RF PCB innovation is crucial to support high-precision, next-gen automotive radar sensors needed for obstacle detection and navigation.

Some key technology and manufacturing trends that will shape the competitiveness of RF PCB suppliers are:

- Adoption of low-loss, high thermal conductivity substrate materials like LCP to enable higher device densification, power efficiency and reliable performance at mmWave frequency bands

- Scalability of HDI PCB production and integrated passive technologies

- High-precision RF modeling, signal integrity simulations and testing at electrical, thermal and mechanical levels

- Automating production flows by leveraging Industry 4.0 technologies

- Access to proven supply chains for sourcing critical raw materials

Competitive Landscape and Market Challenges

The RF PCB and substrate industry is facing supply chain challenges starting from shortages of semiconductor substrates, resins, copper foils to the very PCB manufacturing capacity needed to satisfy today’s demand.

While new investments are being made to increase production over the next 2-3 years, RF PCB companies will need to partner with strategic customers through long-term volume agreements and rigorous capacity planning. Foundries will also need to retain specialized R&D talent and continuously enhance technological know-how in consultation with device makers to meet future requirements.

From a technology viability standpoint, lawmakers and administrations must provide regulatory support with timely approval of new radio spectrum bands for supporting exponential increase in wireless connectivity demands across 5G and WiFi use cases.

Companies will also need to adopt responsible business, sourcing and production practices to minimize carbon footprint and potential environmental hazards. Sustainable electronics and manufacturing is vital for the industry’s long-term growth. With collective action from stakeholders, the RF PCB ecosystem can continue to flourish.

Frequently Asked Questions

Here are some common FAQs about RF PCB manufacturers:

Q1. What are RF PCBs and what makes them challenging to manufacture?

A1. RF printed circuit boards operate at radio frequencies – from under 3 GHz for 4G LTE to over 90 GHz for latest 5G networks. High-frequency signals demand precise dielectric properties, superior signal integrity at multiple lamination interfaces, smooth impedance matching and effective EMI shielding – making them harder to fabricate than typical digital PCBs.

Q2. Why is HDI technology important for advanced RF PCBs?

A2. High Density Interconnect (HDI) allows packing more components and circuitry by adopting thinner dielectric buildup layers (below 60 μm) interconnected by smaller micro-vias (50 to 150 μm diameter), enabling denser RF solutions.

Q3. Are ceramics or laminates better substrates for mmWave RF PCBs?

A3. Both material types have tradeoffs – ceramic substrates generally provide better thermal performance crucial for power amplifiers in mmWave modules but laminates offer greater design flexibility and lower cost. Hybrid RF boards using ceramic tiles embossed on laminate cores are an emerging option.

Q4. What are some emerging technologies used in automotive RF PCBs?

A4. Stringent reliability and environmental resistance requirements for vehicle-use makes adopting RF/microwave materials like liquid crystal polymers along with new interface treatments like plasma activation highly useful to realize robust, long-lasting RF PCB performance.

Q5. What role does modeling and simulation play during RF PCB design?

A5. Platforms like Ansys HFSS, Keysight ADS, Cadence Sigrity, Mentor HyperLynx offer accurate full-wave electromagnetic, thermal, signal integrity and power integrity simulations of complex RF PCBs – minimizing discrepancy between virtual prototyping designs and hardware testing.