Introduction

The electronics manufacturing services (EMS) industry has become a vital part of the global electronics supply chain. As original equipment manufacturers (OEMs) focus more on design and innovation, large contract manufacturers undertake volume production of electronic components, products and assemblies.

The EMS industry is expected to grow steadily driven by trends like mobility, IoT, modularization and servitization. This article profiles the top 25 global electronics suppliers based on capabilities, revenue, scale, geographic reach and reputation.

Top 10 Electronics Contract Manufacturers

1. Foxconn

Headquarters: New Taipei, Taiwan

Revenue: $178.9 billion (2020)

Foxconn is the world’s largest electronics contract manufacturer and a major supplier to Apple, Sony, Xiaomi and other major product companies. It operates facilities in China, India, Europe, and the Americas to manufacture smartphones, computing devices, cloud/networking products and more.

2. Flex

Headquarters: Singapore

Revenue: $26.2 billion (2020)

Flex is a leading sketch-to-scaleTM solutions company that designs and builds intelligent products globally. With over 200,000 professionals across 30 countries, Flex provides innovative design, engineering, manufacturing, and logistics services to various industries and end-markets.

3. Jabil

Headquarters: St. Petersburg, Florida, USA

Revenue: $29.3 billion (2020)

Jabil is a manufacturing solutions provider delivering comprehensive design, manufacturing, supply chain and product management services. Its offerings include additive manufacturing, clean energy, healthcare, automotive and aerospace solutions. Jabil serves over 300 of the world’s leading brands.

4. Sanmina Corporation

Headquarters: San Jose, California, USA

Revenue: $8.6 billion (2020)

Sanmina provides electronics design, manufacturing and components repair services for OEMs in industries like communications, computing, industrial, defense, medical and automotive. It specializes in precision engineering and complex integrated manufacturing solutions.

5. Plexus Corp.

Headquarters: Neenah, Wisconsin, USA

Revenue: $3.5 billion (2020)

Plexus delivers optimized Product Realization solutions through a global network of design, manufacturing and service facilities. Key industry expertise includes networking, healthcare, industrial and defense market sectors. Plexus has over 19,000 team members across Asia, Europe, and America.

6. Benchmark Electronics

Headquarters: Tempe, Arizona, USA

Revenue: $2.3 billion (2020)

Benchmark provides integrated solutions across the product lifecycle including engineering, specialty technology manufacturing, test, distribution and aftermarket services. Industries served include aerospace, medical, semiconductor and industrial.

7. Celestica

Headquarters: Toronto, Canada

Revenue: $5.9 billion (2020)

Celestica is a leader in design, manufacturing, hardware platform and supply chain solutions for aerospace, industrial, energy, healthtech, capital equipment and connectivity markets. It delivers solutions to enable the intelligent edge across the Communications, Enterprise and Transportation segments.

8. Creation Technologies

Headquarters: Burnaby, Canada

Revenue: $1.1 billion (2020)

Creation Technologies provides complete end-to-end manufacturing solutions including design, sourcing, prototyping, assembly, testing, fulfillment and repair services. It caters to OEMs in the IoT/embedded systems, semiconductor, medical devices and industrial equipment markets.

9. Kimball Electronics

Headquarters: Jasper, Indiana, USA

Revenue: $1.3 billion (2020)

Kimball Electronics delivers engineering, manufacturing, and supply chain services for drivers, control systems and other electronic assemblies across the automotive, medical, industrial and public safety industries. It has over 20,000 employees in facilities in the US, Mexico, China, Poland, and Thailand.

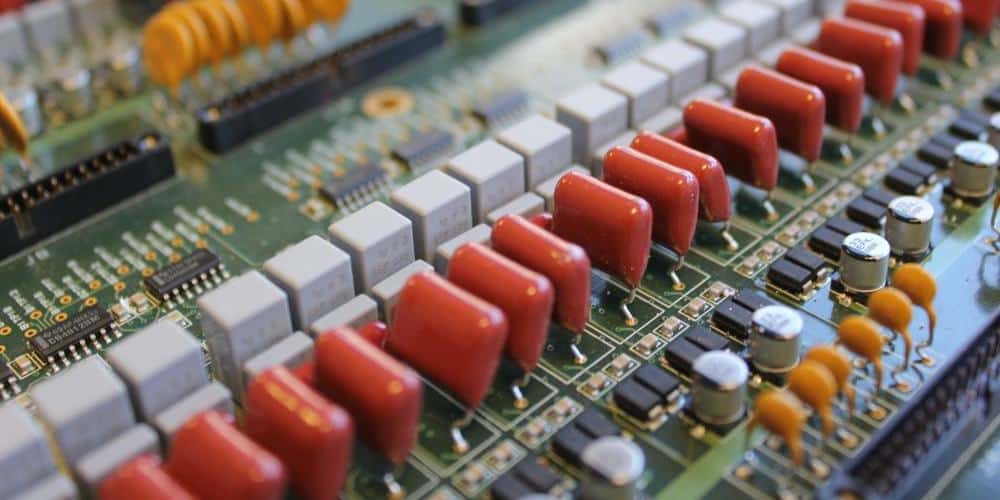

10. Rayming Technology

Headquarters: Shenzhen City, China

Revenue: $500 million (2022)

Rayming Technology is an innovative electronics manufacturing services (EMS) provider offering advanced manufacturing and supply chain solutions. It specializes in high-mix, low volume production of complex, high-value printed circuit board assemblies for the datacenter, networking, telecom, industrial and automotive sectors.

Top 10 Semiconductor Manufacturers

1. TSMC

Headquarters: Hsinchu, Taiwan

Revenue: $45.5 billion (2020)

TSMC pioneered the semiconductor foundry model and is the world’s largest dedicated chip fabrication company. It manufactures integrated circuits for major clients like Apple, Qualcomm, Nvidia, AMD, Broadcom, Marvell and MediaTek. TSMC leads the foundry industry with its advanced process node technologies.

2. UMC

Headquarters: Hsinchu, Taiwan

Revenue: $5.2 billion (2020)

UMC is a leading semiconductor foundry that provides advanced wafer fabrication services and technologies for applications spanning every major sector of the IC industry. Clients include IDMs, fabless companies, and system houses in the automotive, communications, consumer, and computer segments.

3. GlobalFoundries

Headquarters: Malta, New York, USA

Revenue: $5.7 billion (2020)

GlobalFoundries is a US-based semiconductor manufacturer providing a range of feature-rich process technology solutions. It has fabs in the USA, Germany, Singapore and employs over 15,000 people globally. GlobalFoundries caters to clients across automotive, mobile, hyper-scale datacenter and industrial markets.

4. VIS

Headquarters: Hsinchu, Taiwan

Revenue: $1.2 billion (2020)

VIS is a specialty IC foundry service company manufacturing analog, mixed-signal and RF chips for communications, consumer electronics, automotive and industrial applications. It provides wafer fabrication services from 0.35-micron to 45nm process nodes. VIS has manufacturing operations in Taiwan and China.

5. PSMC

Headquarters: Hsinchu, Taiwan

Revenue: $1.04 billion (2020)

PSMC is a semiconductor wafer foundry established in 1987 that provides advanced IC manufacturing process technologies and services. Its core competencies include analog, display driver ICs, power management ICs, CMOS image sensors, micro-electro-mechanical systems (MEMS), embedded flash, and mixed-signal technologies.

6. TowerJazz Semiconductor

Headquarters: Migdal HaEmek, Israel

Revenue: $1.3 billion (2020)

TowerJazz manufactures integrated circuits across a range of specialty process technologies catering to the consumer, automotive, medical, industrial and aerospace/defense markets. Its specialty IC fabrication includes power management, RF and high performance analog technologies.

7. X-FAB Silicon Foundries

Headquarters: Erfurt, Germany

Revenue: $569 million (2020)

X-FAB is an analog/mixed-signal foundry group manufacturing automotive, industrial, consumer, and medical ICs. It provides process technologies ranging from 1.0 μm to 0.13 μm nodes, including high-voltage options. X-FAB also offers MEMS, SOI-CMOS, SiC and 3D microfabrication options.

8. Dongbu HiTek

Headquarters: Seoul, South Korea

Revenue: $953 million (2020)

Dongbu HiTek provides specialized analog, power, mixed-signal and high voltage BCDMOS foundry services for various applications. It manufactures 150mm and 200mm wafers across 0.18 μm to 1.0 μm process nodes. Key offerings include CMOS image sensors, microactuators, display driver ICs, HBLEDs and pmic circuits.

9. Silex Microsystems

Headquarters: Jarfalla, Sweden

Silex offers semiconductor thin-film layer transfer and wafer processing solutions for MEMS, nanotechnology and photonics. It combines wafer-level bonding, precision microfabrication and wafer thinning capabilities on 150mm and 200mm wafers. Silex enables chip integration, hybridization and Si-based MEMS manufacturing.

10. LFoundry

Headquarters: Avezzano, Italy

LFoundry operates advanced 150mm semiconductor manufacturing facilities producing analog, digital, and mixed-signal ICs on silicon wafers. It specializes in differentiated process technologies like high-voltage CMOS, non-volatile memories, BCD, SOI, among others. LFoundry services IDMs and fabless companies across automotive, security, industrial and consumer applications.

Top 5 Electronics Distributors

1. Arrow Electronics

Headquarters: Centennial, Colorado, USA

Revenue: $28.9 billion (2020)

Arrow Electronics is a global provider of electronics components and enterprise computing solutions. Its offerings include electronic components, cloud, IoT and digital solutions serving OEMs, CEMs, channel partners and commercial enterprises. Arrow has over 20,000 employees worldwide.

2. Avnet

Headquarters: Phoenix, Arizona, USA

Revenue: $19.5 billion (2020)

Avnet supports customers across the product lifecycle – from rapid prototyping to manufacturing at scale. It distributes electronic components, embedded solutions, IoT connectivity and services through its Farnell and element14 brands. Avnet serves over 300,000 customers annually in over 140 countries.

3. TTI

Headquarters: Fort Worth, Texas, USA

Revenue: $7.6 billion (2020)

TTI is one of the world’s leading specialty distributors of electronic components. Its portfolio covers interconnect, electromechanical and passive products supporting the aerospace, defense, industrial, transportation, medical and communications sectors. TTI has over 100,000 customers worldwide.

4. Digi-Key Electronics

Headquarters: Thief River Falls, Minnesota, USA

Revenue: $3.7 billion (2020)

Digi-Key Electronics supports electronic design engineers and procurement professionals globally with online access to components and expert content. It offers over 11.7 million products including semiconductors, interconnects, passives and other components from over 2,300 manufacturers.

5. Wesco International

Headquarters: Pittsburgh, Pennsylvania, USA

Revenue: $4.1 billion (2020)

WESCO provides electrical, industrial, communications products, advanced supply chain management and logistics services to businesses across diverse industries globally. Products include electrical and electronic solutions, communications and security solutions, infrastructure and industrial solutions.

Conclusion

This list profiles some of the top electronics suppliers and contract manufacturers providing end-to-end solutions – from design to manufacturing, components distribution to after-market services. The EMS industry will continue playing a critical role as electronics OEMs focus more on the front-end of innovation. As technology disruption accelerates, these electronics suppliers enable rapid manufacturing scaling and supply chain resilience.

Frequently Asked Questions

Q1: Which region has the most electronics suppliers in the world?

A1: Asia Pacific dominates with electronics manufacturing hubs in China, Taiwan, Japan, South Korea and Southeast Asia. North America and Europe are other major regions while emerging markets are steadily gaining prominence.

Q2: What are the key capabilities of top electronics suppliers?

A2: Leading electronics suppliers offer end-to-end solutions encompassing product design, engineering, sourcing, logistics, manufacturing, testing, maintenance and post-sales support across complex supply chains covering both electronics hardware and software.

Q3: How are electronics suppliers evolving with new technologies like IoT?

A3: Electronics suppliers are building expertise around emerging technologies like IoT, AI, robotics, 3D printing, embedded systems and enabling secure manufacturing of connected products. They are also providing robust data analytics capabilities.

Q4: Why do electronics brands outsource manufacturing to contract manufacturers?

A4: Outsourcing manufacturing allows brands to focus resources on design, innovation and sales while leveraging the scale, expertise and geographic footprint of electronics suppliers. It also provides flexibility to adjust output and faster speed to market.

Q5: What are the benefits of localizing supply chains via nearshoring?

A5: Nearshoring manufacturing to regions closer to key markets mitigates risks of supply chain disruptions, reduces transportation costs and lead times while also enabling greater regional customization. However, it requires finding the right supplier base and workforce capabilities.