Introduction

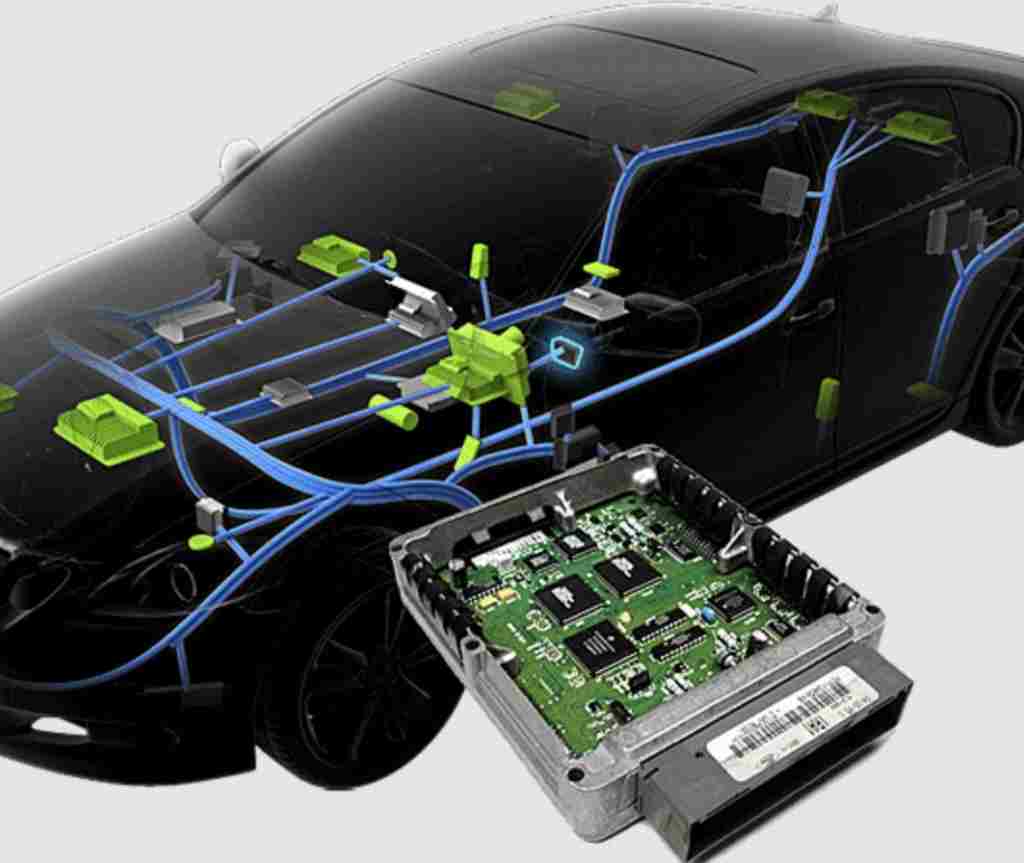

The massive growth in vehicles featuring connected, electric and autonomous functionality has greatly expanded the role of automotive electronics suppliers. Advanced driver assistance systems (ADAS), in-vehicle infotainment (IVI), powertrain systems and body electronics enable modern vehicle capabilities but also increase complexity.

Selecting the right automotive electronics partners is crucial for OEMs and tier-1 suppliers to deliver next-generation automobiles. This article profiles the 10 leading automotive electronics manufacturers across metrics like:

- Key products and technology

- R&D capabilities

- Manufacturing scale

- Partnerships and customers

- Revenue and future outlook

Understanding the landscape of major automotive electronics vendors will help identify the optimal suppliers for projects ranging from ECU engine controllers to LiDAR sensor perception. Let’s examine the top 10 global providers shaping the future of vehicle electronics.

1. Bosch

Headquarters: Gerlingen, Germany

2021 Automotive Revenue: $54.6 billion

Main Automotive Products: Powertrain systems, ADAS, infotainment, sensors

Robert Bosch GmbH is the world’s largest automotive electronics and component manufacturer thanks to its leadership in powertrain systems, driver assistance and infotainment.

Key Bosch Automotive Products and Technologies

- Gasoline and diesel engine control units

- Electric and hybrid vehicle power electronics

- Radar, camera and ultrasonic sensors

- Automated driving domain controllers

- Infotainment and telematics units

- Battery management systems

- Electric power steering

- Windshield wipers and lighting

Bosch supplies core domains across powertrain, driver assistance, body electronics and user experience. Its broad portfolio makes it well positioned as a primary systems integrator for OEMs.

Global R&D and Manufacturing Scale

Bosch operates over 465 R&D centers globally including large hubs in Germany, Japan, India, China and the United States. This allows developing electronics innovations locally for each region.

For manufacturing, Bosch operates over 150 automotive electronics and component factories worldwide. Local and regional production enables cost-optimized supply chains to OEM plants.

Key Automotive Partnerships and Customers

As a tier-1 mega-supplier, Bosch has relationships with practically every global OEM. Key customers include:

- Volkswagen Group – Powertrain, sensors and cockpit electronics

- General Motors – ADAS and user experience systems

- Mercedes-Benz – Sensor fusion and automated driving

- Hyundai/Kia – Radar, vision and telematics

Bosch also partners selectively with leading semiconductor vendors for next-generation computing like AI accelerator chips.

Financials and Outlook

- 2021 total sales were $89 billion, with automotive making up 61% at $54.6 billion

- Bosch aims to be the leader in vehicle automation and electrification

- Major investments planned in bipolar-CMOS-DMOS (BCD) wafer fabrication for power electronics and silicon carbide (SiC) technology

- Targeting continued growth in sensors, power electronics and domain controllers

With its scale, breadth of products and aggressive electrification roadmap, Bosch is positioned to remain the world’s largest automotive technology provider over the next decade.

2. Denso

Headquarters: Aichi, Japan

2021 Automotive Revenue: $48.3 billion

Main Automotive Products: Thermal systems, ADAS, body electronics, electrification

Denso is a long-time leader in small motor drives, climate systems and body electronics supplies thanks to deep roots with Japanese OEMs. The company is investing heavily to expand capabilities in vehicle automation, connectivity and electrified powertrains.

Key Denso Automotive Products and Technologies

- HVAC and thermal management systems

- Power steering, wiper and lighting systems

- Electric and hybrid vehicle components

- ADAS sensing including radar, LiDAR and cameras

- Instrument clusters, head-up displays, telematics

- Microcontrollers, security chips

- Connected vehicle solutions

- Factory automation equipment

Denso covers core vehicle body systems but is expanding aggressively in ADAS, infotainment and electrification.

Global R&D and Manufacturing Scale

Headquartered in Japan, Denso operates 17 R&D centers across Japan, the Americas, Europe and Asia. The global sites allow developing innovations tailored per region.

For manufacturing, Denso runs over 200 facilities in 35 countries producing vehicle climate systems, electric drives, sensors and electronic components. The geographic diversity provides proximity to major OEM plants worldwide.

Key Automotive Partnerships and Customers

As a member of the Toyota Group, Denso has very close relationships supplying Toyota and Lexus vehicles. Other key customers include:

- Honda – Thermal systems, body electronics, ADAS components

- Nissan – Hybrid drives, battery sensors, body modules

- General Motors – Climate systems, instrument displays

- Suzuki – Sensors, body electronics and ECUs

Partners include Nvidia, BlackBerry QNX, Toshiba and Qualcomm to advance connectivity and self-driving systems.

Financials and Outlook

- 2021 revenue was $47.6 billion, with automotive sales making up 95% at $48.3 billion

- Denso is targeting growth in ADAS, connectivity, shared mobility and electrification

- Plans to invest $40B over the next decade in R&D and future technology

- Focus areas include vehicle automation, security chips and manufacturing

With heavy investment and its deep customer relations, Denso is primed for continued growth as a tier-1 supplier across new automotive domains.

3. Aptiv

Headquarters: Dublin, Ireland

2021 Automotive Revenue: $15.6 billion

Main Automotive Products: ADAS, vehicle architecture, high voltage systems

Aptiv specializes in advanced driver assistance systems, high voltage components, architecture integration and connectivity. The company was formed in 2011 from the automotive electronics division of Delphi Technologies.

Key Aptiv Automotive Products and Technologies

- Advanced driver assistance system platforms

- Perception sensors including cameras, radar and LiDAR

- High voltage power distribution and protection

- In-vehicle networking architectures

- Vehicle compute modules and domain controllers

- Connectivity gateways and telematics

- Display audio and user experience interfaces

- Smart vehicle architecture frameworks

Aptiv focuses on leading ADAS, software, architecture and high voltage capabilities critical for autonomous and electric vehicles.

Global R&D and Manufacturing Scale

Headquartered in Ireland, Aptiv has technical centers across North America, Europe and Asia to develop regionalized vehicle solutions.

Manufacturing and customer service sites are located strategically based on OEM cluster locations in the Americas, Europe and Asia. This geographic diversity provides responsiveness.

Key Automotive Partnerships and Customers

As an independent tier-1 supplier, Aptiv holds relationships with a diverse spectrum of OEMs including:

- BMW – Autonomous driving solutions

- Hyundai – ADAS and software systems

- Volkswagen – Architecture electronics

- Volvo – Compute platforms

- GM – Vehicle networking and power systems

- Ford – Displays and human machine interfaces

The company also partners selectively with technology firms on automotive projects.

Financials and Outlook

- 2021 revenue was $15.6 billion focused exclusively on automotive sales

- Strategic acquisitions have strengthened capabilities in software, autonomy, vehicle architecture and power electronics

- Major investments planned in scalable ADAS solutions as autonomous platforms evolve

- Leveraging robust vehicle computing expertise into smart mobility platforms

With its competencies across high growth automotive domains, Aptiv is poised for expansion over the next decade.

4. Continental

Headquarters: Hanover, Germany

2021 Automotive Revenue: $26.4 billion

Main Automotive Products: ADAS, body electronics, tires, interior components

Continental is a leading German automotive supplier offering a diverse range of vehicle technologies including ADAS, autonomous driving, infotainment, connectivity, tires, and body systems.

Key Continental Automotive Products and Technologies

- ADAS and autonomous driving assistance systems

- Surround view and camera monitoring

- Body electronics and gateways

- Digital instrument clusters and HMI

- Telematics and connectivity control units

- Tire pressure monitoring and wheel electronics

- Interior components, displays and HMI

Continental covers vehicle electronics along with traditional strengths in tires, interior systems and visibility systems.

Global R&D and Manufacturing Scale

Continental operates over 250 facilities globally including 20 major R&D locations and 8 regional automotive competence centers. This distribution allows developing intelligent mobility solutions tailored to local requirements.

Vehicle electronics, sensors, tires and interior components are manufactured in Continental factories across Europe, the Americas and Asia in proximity to customer regions.

Key Automotive Partnerships and Customers

Continental holds long-standing supplier relationships with most major automakers including:

- Volkswagen and Audi – ADAS, tires, body systems, interiors

- BMW – Cameras, sensors, tire solutions

- Mercedes-Benz – Autonomous platforms, interiors

- Ford – Instrument clusters, connectivity modules

- Renault Nissan Mitsubishi – Sensing, ECUs, infotainment

Joint ventures and partnerships focus mainly on tire production support.

Financials and Outlook

- 2021 total sales were $39 billion with automotive technologies at $26.4 billion

- Auto unit sales expected to rise driven by ADAS, autonomy and body electronics

- Additional acquisitions targeted to expand software and autonomous driving expertise

- Plans to spin off powertrain and interior businesses to focus on intelligent mobility systems

Continental’s realignment to intelligent systems paired with trusted automotive capabilities position it for sustained growth.

5. Veoneer

Headquarters: Stockholm, Sweden

2021 Automotive Revenue: $1.9 billion

Main Automotive Products: ADAS and autonomous driving technology

Veoneer specializes exclusively in advanced driver assistance systems (ADAS), collaborative driving, and autonomous vehicle development. The company was formed in 2018 via a spin-off from airbag and seatbelt supplier Autoliv to focus on vehicle automation.

Key Veoneer Automotive Products and Technologies

- Vision systems including cameras, hardware and perception software

- Radar, LiDAR and other sensing technologies

- Fusion ECUs for combining vision, radar and LiDAR inputs

- Drive policy and planning software for collaborative driving

- Human machine interfaces and occupant monitoring

- Braking, steering and other actuator systems

Veoneer targets the full ADAS sensing and software stack critical for automated vehicles.

Global R&D and Manufacturing Scale

Headquartered in Sweden, Veoneer maintains a global footprint of R&D, labs and manufacturing facilities across Europe, North America and Asia. This geographic diversity allows developing and producing ADAS solutions tailored per region.

Key sites include Sweden for vision systems, Germany for radar and Canada for software and integration. New facilities are added to support partnership activities as well.

Key Automotive Partnerships and Customers

As an independent ADAS pure-play company, Veoneer partners selectively with leading technology firms to advance capabilities. Collaborations include:

- Qualcomm – Integrated ADAS platform combining vision and Snapdragon processors

- Zenuity – Joint venture for collaborative driving software

- Nvidia – Developing full-stack self-driving vehicle software

Key OEM customers span European, US and Asian automakers including Volvo, Volkswagen, Mercedes-Benz, GM, Honda and Hyundai.

Financials and Outlook

- 2021 revenue was $1.9 billion from ADAS products and development

- Strategic partnerships targeted to accelerate development timelines

- Focused investments planned around vision systems, perception software and actuation

- Well positioned to capitalize on surging ADAS demand with Tier-1 automakers

Veoneer’s ADAS market focus makes it poised for growth as autonomous features increase.

6. Visteon

Headquarters: Van Buren, Michigan

2021 Automotive Revenue: $2.8 billion

Main Automotive Products: Instrument clusters, infotainment, cockpit domains

Visteon is a long-time major supplier focused on cockpit electronics including instrument clusters, infotainment systems, displays, telematics and emerging cockpit domain controllers. The company was originally a division of Ford Motor Company before becoming independent in 2000.

Key Visteon Automotive Products and Technologies

- Analog and digital instrument clusters

- Head-up displays and augmented reality

- Infotainment hardware and solutions

- Telematics and connectivity modules

- Audio systems and amplifiers

- Displays and human machine interfaces (HMI)

- Emerging cockpit domain controllers

- Automotive grade hardware components

Visteon specializes in the driver information and in-vehicle experience electronics that are shifting towards more integrated cockpit systems.

Global R&D and Manufacturing Scale

Headquartered in Michigan, Visteon maintains a global footprint of technical and manufacturing sites across the Americas, Europe and Asia including over 20 facilities in Mexico, Portugal, India and China. The geographic spread allows localized development and production.

Global R&D centers create innovations tailored specifically for target customer regions.

Key Automotive Partnerships and Customers

Visteon supplies cockpit electronics to a broad range of automakers including:

- Ford – Instrument clusters, displays and infotainment

- BMW – Driver information displays and IVI

- Daimler – Instrument clusters and infotainment

- Renault-Nissan-Mitsubishi Alliance – Audio and telematics

- Geely – Digital clusters, audio systems

The company partners with technology leaders on advanced initiatives like augmented reality, user experience and electrification.

Financials and Outlook

- 2021 sales were $2.8 billion derived exclusively from auto manufacturers

- Visteon is pivoting from hardware to more software-based solutions

- Investments aimed at next-generation cockpit domain controller technology to centralize functions

- Well positioned to capitalize on instrument cluster and infotainment growth

Visteon’s cockpit electronics specialization places the company in prime position as domains consolidate and displays evolve.

7. Magna

Headquarters: Aurora, Canada

2021 Automotive Revenue: $38.8 billion

Main Automotive Products: Contract manufacturing, ADAS and autonomy

Magna is one of the world’s largest diversified automotive suppliers covering complete vehicle engineering and contract manufacturing in addition to ADAS technologies.

Key Magna Automotive Products and Technologies

- Full vehicle contract manufacturing and assembly

- Complete vehicle engineering services

- ADAS sensors and perception platforms

- Camera modules and vision systems

- ADAS domain controller hardware

- Radar units and exterior vision technology

- Autonomous driving assistance software

- Electric vehicle motors and drivetrains

- High voltage power distribution

Magna provides core ADAS hardware and autonomy along with design, engineering and manufacturing services for OEMs.

Global R&D and Manufacturing Scale

Headquartered in Canada, Magna has a global footprint with over 250 manufacturing operations and more than 60 R&D, engineering and product development centers. Facilities are strategically located based on customer region.

The company can provide complete localization and manufacturing in all key automotive markets.

Key Automotive Partnerships and Customers

Magna has relationships across practically every global automaker for contract manufacturing and vehicle services including:

- Mercedes-Benz – ADAS, vision systems, EV motors

- BMW – Manufacturing, ADAS, vision systems

- Stellantis – Body components, ADAS

- GM – Vehicle manufacturing and assembly

- Ford – ADAS sensors and autonomy

Joint ventures support local production in target regions.

Financials and Outlook

- 2021 total sales were $36.2 billion with automotive revenues of $38.8 billion

- World’s 3rd largest automotive supplier based on total sales

- Targeting growing opportunities in electric vehicle powertrains and ADAS/autonomy

- Leveraging manufacturing expertise for flexible contract assembly

- Partnerships to advance autonomous vehicle capabilities

With its vast automotive reach and expertise, Magna is strongly positioned to capitalize across emerging high-growth segments.

8. Hyundai Mobis

Headquarters: Seoul, South Korea

2021 Automotive Revenue: $26.9 billion

Main Automotive Products: ADAS, chassis, cockpit modules

Mobis is the parts and service subsidiary of Hyundai, deeply focused on ADAS technologies, chassis systems and modular cockpit systems.

Key Hyundai Mobis Automotive Products and Technologies

- Camera-based vision systems and sensors

- Radar systems

- LiDAR technologies

- Integrated control units

- Chassis modules including steering, braking, suspension

- Cockpit modules integrating clusters and infotainment

- Connected car software and infrastructure

- Electric vehicle components

- Autonomous valet parking systems

Mobis combines ADAS expertise with large-scale module and system integration capabilities.

Global R&D and Manufacturing Scale

Headquartered in Seoul, Mobis operates major technology centers across Korea along with R&D labs and manufacturing in China, Europe, India and North America. This allows developing and producing locally for target markets.

The R&D staff exceeds 10,000 engineers focused on ADAS and vehicle electronics innovation.

Key Automotive Partnerships and Customers

As the main affiliate of Hyundai Motor Group, Mobis is the primary supplier for:

- Hyundai – ADAS, chassis, cockpits, modules

- Kia – ADAS, chassis, cockpits, modules

- Genesis – Luxury vehicle technologies

Mobis also supplies other automakers in Korea and internationally. Strategic partnerships advance capabilities in software, sensing and EVs.

Financials and Outlook

- 2021 sales were $30.5 billion with automotive parts contributing $26.9 billion

- Heavily focused on expanding ADAS and autonomy for Hyundai as well as global OEMs