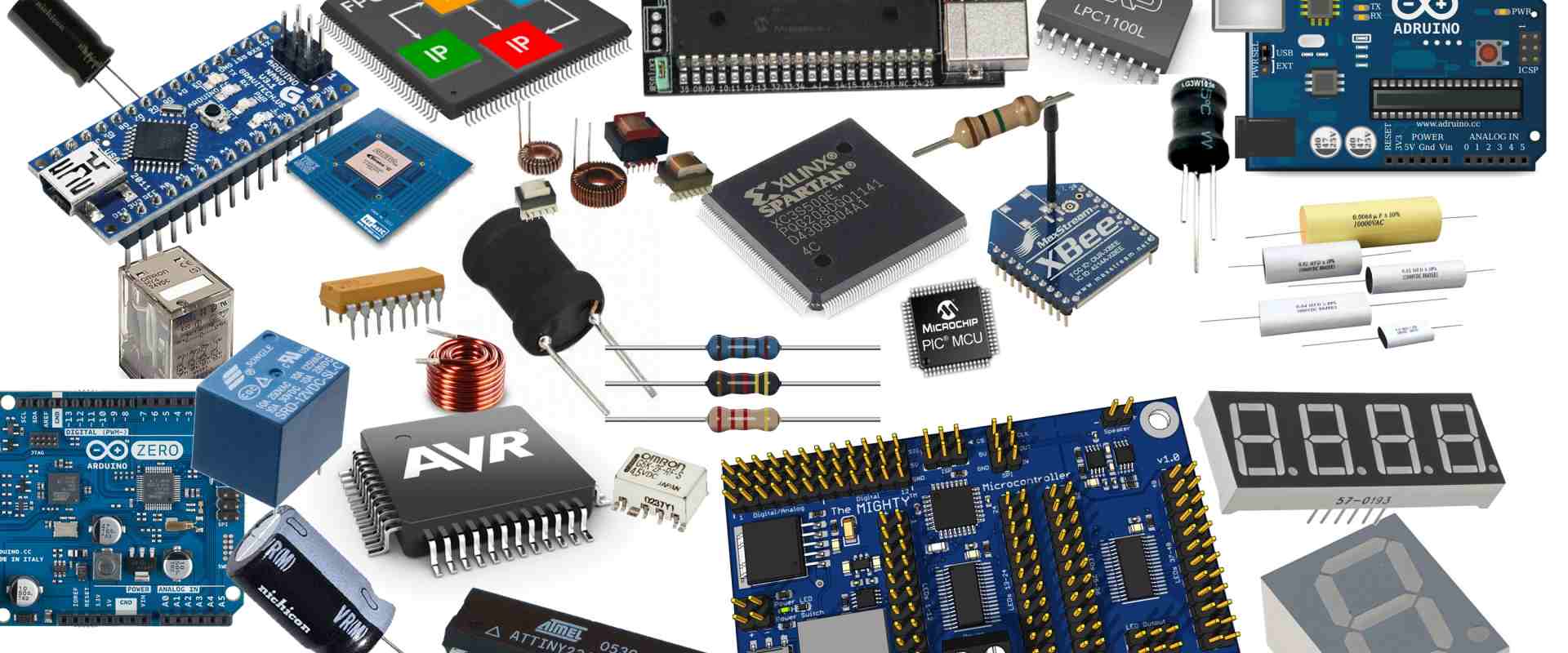

The electronics components industry is a massive global business supplying parts and materials for all types of electronic devices and systems. From semiconductors to passives, electromechanical components to displays, there are hundreds of suppliers vying for business in this competitive sector. This article profiles the 12 leading electronics components suppliers with details on their offerings, strengths and global standing.

1. Samsung Electronics

Headquarters: Suwon, South Korea

Products: Semiconductors, displays, memory, smartphones

Samsung is the world’s largest electronics manufacturer by revenue. It is best known for consumer devices like smartphones, TVs and home appliances. However, Samsung is also the leading memory chip maker with over 17% global market share in DRAM and NAND flash memory. Its semiconductor division also manufactures logic chips, display drivers, image sensors, and power management ICs.

Global Presence: Samsung has manufacturing as well as R&D operations spread across South Korea, USA, China, Vietnam, India, Israel, Japan etc. It has a vast global sales and distribution reach.

2. Intel

Headquarters: Santa Clara, California, USA

Products: Microprocessors, chipsets, SSDs, FPGAs, wireless chips

Intel is the world’s largest semiconductor chip maker by revenue. It is the inventor of the x86 series of microprocessors found in most personal computers. Intel also makes high-end chips for data centers, embedded applications, memory chips, programmable solutions and wireless connectivity modules for computers and handheld devices.

Global Presence: Intel has advanced manufacturing facilities in the USA, Ireland, Israel and China. It has design/R&D centers worldwide and caters to clients globally.

3. Taiwan Semiconductor Manufacturing Company (TSMC)

Headquarters: Hsinchu, Taiwan

Products: Semiconductor foundry, IC fabrication

TSMC is the world’s largest dedicated semiconductor foundry, manufacturing integrated circuits wafers for fabless chip designers. Its 8” and 12” fabs employ cutting edge fabrication technology to make chips across various nodes down to 3nm. TSMC manufactures CPUs, GPUs, SoCs, FPGAs, RF chips for leading technology firms.

Global Presence: TSMC operates wafer fabs in Taiwan, China, USA and Japan. It has design/sales support globally and caters to customers worldwide.

4. SK Hynix

Headquarters: Icheon, South Korea

Products: Memory semiconductor chips – DRAM, NAND Flash

SK Hynix is a leading memory chip maker supplying DRAM and NAND flash memory components used in computers, data centers, mobile devices, automotive etc. It has the second largest market share in DRAM and NAND flash memory worldwide after Samsung Electronics.

Global Presence: SK Hynix has chip fabrication plants in South Korea, China and USA. It serves clients across the electronics industry worldwide.

5. Micron Technology

Headquarters: Boise, Idaho, USA

Products: Memory chips – DRAM, NAND Flash, storage solutions

Micron makes advanced memory and storage solutions including DRAM, NAND flash memory, SSDs and USB drives. It is the 3rd largest DRAM manufacturer and 6th largest NAND flash vendor worldwide. Its memory chips enable advanced computing, networking, smartphones, automotive and industrial systems.

Global Presence: Micron has manufacturing operations in the USA, Singapore, Japan, Taiwan, China and Malaysia. It provides memory products and solutions to customers globally.

6. Broadcom

Headquarters: San Jose, California, USA

Products: Semiconductors for wired, wireless communications, storage, industrial

Broadcom designs, develops and supplies a range of semiconductor and infrastructure software solutions. Its products cater to four key end markets – wired infrastructure, wireless communications, storage, and industrial & others. Broadcom is a leading vendor of chips for broadband, networking, set-top boxes, smartphones etc.

Global Presence: Broadcom has R&D centers and sales offices in over 25 countries. Its chips and technology power electronic devices globally across end markets.

7. NVIDIA

Headquarters: Santa Clara, California, USA

Products: GPUs, high performance computing chips, automotive computers

NVIDIA is best known for its powerful graphics processing units (GPUs) that render advanced graphics in computers and mobile devices. It also makes artificial intelligence computing chips, system-on-chip modules for autonomous vehicles, and hardware for high performance data centers.

Global Presence: NVIDIA sells its advanced GPUs and accelerated computing platforms across the Americas, Europe and Asia Pacific.

8. Qualcomm

Headquarters: San Diego, California, USA

Products: Semiconductors for wireless communications – cellular, wifi, bluetooth

Qualcomm invents and commercializes foundational technologies for the wireless industry. It is a leading developer of chips, software, IP, reference designs and wireless sub-systems for 5G and 4G cellular networks as well as Wi-Fi and Bluetooth connectivity.

Global Presence: Qualcomm works with over 14,000 customers across the wireless ecosystem worldwide. Its technology powers connected devices globally.

9. Texas Instruments (TI)

Headquarters: Dallas, Texas, USA

Products: Analog ICs, embedded processors, calculators

TI is a global supplier of analog chips, embedded processors and DLP projection technology. Its extensive analog IC portfolio includes amplifiers, data converters, interface ICs, power management and more. TI’s OMAP application processors power millions of electronics devices.

Global Presence: TI has design, manufacturing and sales operations across 35+ countries. Its chips and technologies serve 100,000+ customers worldwide.

10. Rayming Technology

Headquarters: Shenzhen, China

Products: Printed Circuit Boards (PCB), Full Turnkey Services

RayMing is a dedicated Printed Circuit Board& Electronic Manufacturing Services (EMS) provider. It offers a complete range of PCB solutions including Rigid, Flex, Rigid-Flex PCBs, Heat Sinks, Units Assembly and Components Procurement. Its comprehensive strength covers quick-turn prototypes till mid-volume production.

Global Presence: Rayming has clients in communication, industrial control, automotive electronics, medical equipment and testing instruments across worldwide regions like North America, Europe and Asia.

11. Murata Manufacturing

Headquarters: Kyoto, Japan

Products: Ceramic capacitors, piezoelectrics, sensors, power modules

Murata is a leading global supplier of ceramic-based passive electronic components like multi-layer capacitors, inductors, filters, resistors, thermistors and piezoelectric devices. It also offers various modules, connectivity/wireless modules and power supplies.

Global Presence: Murata has production facilities and sales offices across the world covering the Americas, Europe, China and Southeast Asia.

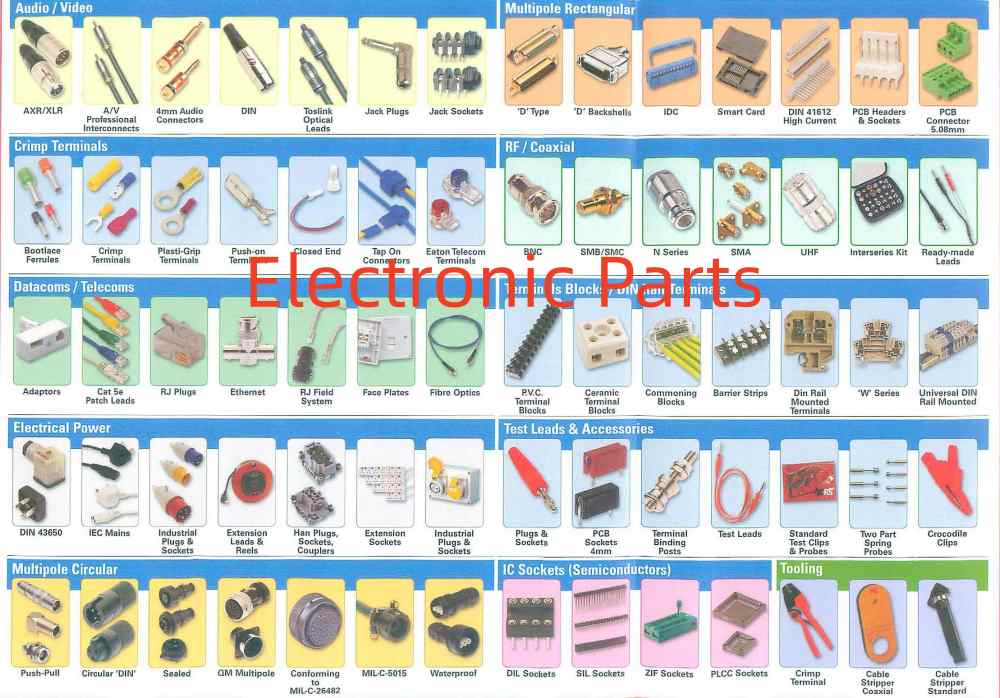

12. Amphenol

Headquarters: Wallingford, Connecticut, USA

Products: Interconnect products, antennae, coaxial cables, connectors

Amphenol makes connection devices and systems for applications requiring electronics to enable functions like communications, information processing, power management, transportation and more. Its products include connectors, antennae, sensors, cables and interconnect systems.

Global Presence: Amphenol has an active presence in over 30 countries with manufacturing operations and local field sales teams.

Key Strengths of Top Suppliers

Here are some of the core strengths and capabilities that make these companies leading players in the competitive electronics components industry:

- Technical expertise in high-volume manufacturing – Companies like Intel, Samsung, TSMC excel in mass production of semiconductor chips and other components leveraging cutting edge fabrication technology, automation and lean philosophies.

- Command over electronics technologies – Leaders have full-fledged research labs and armies of scientists driving innovation in areas like processors, memory, sensors, interconnects, wireless communications etc.

- Collaborations – Many leading suppliers work closely with customers right from design to delivery through co-development partnerships and collaborations.

- Established relationships – Top vendors foster close business relationships with customers to better understand their technology/product roadmaps.

- Global footprint – Large production capacities combined with worldwide presence in sales/support enables addressing customers anywhere.

- Breadth of product portfolio – Many suppliers offer a diverse range of components for multiple applications rather than niche products.

- Brand reputation – Dominant vendors have billions invested in brand development and are seen as reliable suppliers by customers.

Major End Markets Served

The major end markets served by these top electronics components suppliers include:

- Consumer Electronics – smartphones, laptops, gaming devices, home appliances

- Automotive – infotainment systems, ADAS, electric/autonomous vehicles

- Telecommunications – 5G, networking, broadband, cellular infrastructure

- Data Centers – servers, computing, storage, networking, infrastructure

- Aerospace and Defense – avionics, radars, weaponry, surveillance systems

- Medical – diagnostic equipment, surgical tools, implants, health monitoring

- Industrial – robotics, factory automation, IoT, test and measurement

Leading suppliers cater to most or all of these end markets which have growing appetite for advanced electronic components enabling smart, connected products and systems.

Geographic Revenue Distribution

Here is an approximate regional revenue distribution for the major electronics component suppliers:

| Supplier | Americas | Europe | Asia Pacific | China |

|---|---|---|---|---|

| Samsung | 15-20% | 10-15% | 25-30% | 15-20% |

| Intel | 40-45% | 20-25% | 15-20% | 5-10% |

| TSMC | 25-30% | 5-10% | 10-15% | 40-45% |

| SK Hynix | 10-15% | 5-10% | 15-20% | 50-60% |

| Micron | 60-65% | 5-10% | 15-20% | 5-10% |

| Broadcom | 25-30% | 15-20% | 15-20% | 15-20% |

| Nvidia | 25-30% | 15-20% | 15-20% | 15-20% |

| Qualcomm | 65-70% | 5-10% | 20-25% | N/A |

| Texas Inst. | 40-45% | 15-20% | 25-30% | 5-10% |

Asia Pacific and China together account for the lion’s share of revenue for most suppliers given the high electronics manufacturing in this region. Many top suppliers have a limited presence within China.

Competitive Analysis

The electronics components industry is highly competitive. Here is a brief competitive analysis:

- Semiconductor manufacturing is dominated by Samsung, Intel, TSMC, SK Hynix who compete aggressively on advancing manufacturing technology. Competition is based on innovation, product performance, quality, pricing and supply security.

- Memory chips is a segment where Samsung, SK Hynix and Micron enjoy leadership driven by their IP, high capital intensity and scale. There is intense rivalry within memory suppliers.

- Wireless communications sees Qualcomm constantly competing with MediaTek, Samsung LSI, HiSilicon and UNISOC based on wireless expertise and integration.

- Analog semiconductors is a fragmented space where Texas Instruments faces competition from ST Microelectronics, Infineon, ON Semiconductor etc.

- Connectors and cables has Amphenol competing with TE Connectivity, Molex, JST, Foxconn and other players on basis of reliability, durability, design innovation.

Overall the market constantly witnesses shifting competitive dynamics, mergers and acquisitions, new technology disruption and Asian players challenging established leaders.

Future Outlook

Here are the major trends shaping the competitive landscape for electronics components suppliers going forward:

- Advent of 5G and exponential data growth will fuel demand for faster, efficient semiconductors.

- Transition to EVs, connectivity and autonomy will drive automotive electronics.

- Growth in IoT will require sensors, connectivity and analytics chips at scale.

- Advances in artificial intelligence will require specialized high-performance computing hardware.

- Rising focus on supply chain resilience against global shocks.

- Industry consolidation as leading players acquire competencies through M&As.

- China’s national policy aimed at bolstering its domestic semiconductor industry.

The leading electronics components suppliers are poised to benefit from the enormous growth opportunities as technologies like 5G, AI, IoT and autonomous systems gain broader adoption globally. However, they need to counter margin pressures and new competitive threats by leveraging scale, collaborations and continuous innovation.

Frequently Asked Questions

Q: Who are the top 5 semiconductor companies in the world?

A: The top 5 semiconductor companies globally are Samsung Electronics, Intel, Taiwan Semiconductor Manufacturing Company (TSMC), SK Hynix and Micron Technology. They lead in manufacturing processors, memory chips, sensors and other integrated circuits.

Q: Which countries have the most electronics manufacturing?

A: China, Taiwan, South Korea, Japan and the United States are the top countries in electronics manufacturing. China is the largest electronics production base due to availability of labor, scale and comprehensive supply chain ecosystems.

Q: What companies make the most smartphone components?

A: Key smartphone component suppliers are Samsung (displays/memory), Qualcomm (processors/modems), Sony (image sensors), Corning (Gorilla Glass), Amphenol (antennae), Murata (capacitors) and TI/STMicro (power management ICs).

Q: Who are the largest connector and cable manufacturers?

A: Top cable and connector companies are TE Connectivity, Amphenol, Molex, Luxshare Precision, Foxconn, JST, Yazaki, 3M, Huber+Suhner and Rosenberger. They supply interconnects for telecom, automotive, industrial, medical, aerospace, consumer electronics.

Q: What new technologies are electronics component suppliers investing in?

A: Key technology focus areas are AI chips, advanced packaging, 3D/2.5D integration, advanced memory like MRAM, new materials like gallium nitride, silicon carbide, 5G systems and quantum computing hardware.